What Artists and Creatives Need to Know this Tax Season

Experts from Brass Taxes cover tax season fundamentals.

Do you find tax season stressful and unnecessarily confusing? It’s not just you! This post shares insights from Brass Taxes, a team of tax preparers who deliver personalized tax guidance to freelancers and artists.

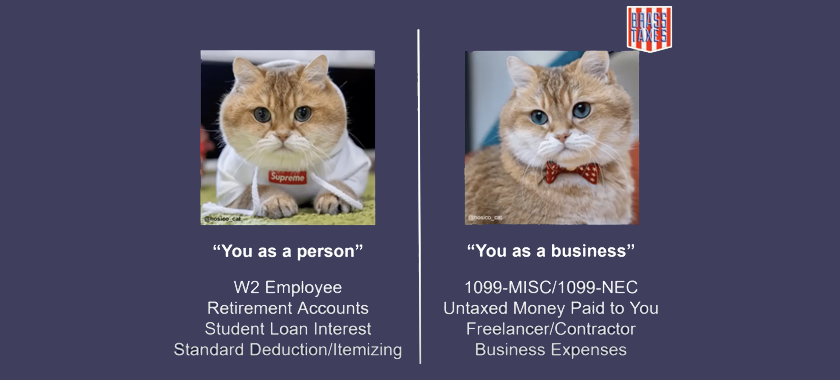

You as a Person vs You as a Business

As an individual taxpayer (or person), you might receive a W-2 form or unemployment or have retirement accounts or student loan interest.

The terms “freelancer, independent contractor, self-employed” mean someone who is making untaxed money as a business.

Anytime you get paid untaxed money, you’re a business. “If somebody says, ‘I want you to draw a circle on a piece of paper and I’m going to give you $100’ and they hand you $100, poof…you’re a business,” explains Rus Garofalo, Founder of Brass Taxes. “Anytime taxes are not taken out of money you’re getting for services or products, you’re in business. You might get a 1099-MISC or a 1099-NEC, but regardless of whether you’re getting a form, you are a business.”

Garofalo continues: “Once you’re making untaxed money, you now have a parallel version of yourself. There’s tax stuff related to you as a person, and then there is you as a business. And there are different rules on each side of these. The first thing is to recognize that there is a separation, and at the end of the tax return they come back together.”

One advantage of being a business is that you can write off business expenses—like taking classes, entering contests and festivals, traveling for your creative work, and paying for rehearsal space, you can subtract the expenses that you have from your creative work.

When you’re conducting yourself as a business, as long as you are trying to make a profit, you are considered a business in the eyes of the IRS (this does not mean that you are making a profit). A common myth is that you can only claim a loss for three to five years to be a business. Garofalo says this is rarely true for artists.

For those curious about LLCs, Brass Taxes Chief Operating Officer Eric Stoddard dispels the notion that you need to formally incorporate to be considered a business. “If you have untaxed income coming in, whether it’s a 1099, cash/check, Venmo, whatever, the IRS considers you a business,” he stressed.

“You do not need to have an LLC to be able to take advantage of any of these business expenses,” he added, noting that some folks do choose to register as an LLC for some liability protections. You can find more information about whether to form an LLC here via Brass Taxes website.

Key Tips and Recommendations

Keep track of your business expenses, at least monthly. “The reason it’s important to track your expenses is because you don’t pay tax based on how much money you got paid, you pay taxes on what’s left over, after your expenses,” says Garofalo.

For tracking expenses, Garofalo suggests using the “three minute rule,” meaning that if it takes longer than three minutes to document a little expense, your system is too complicated. Lean into what works best for you, even if that means keeping physical receipts in envelopes, each one corresponding to a tax category. An acceptable receipt for the IRS includes Date, Item, Amount, and Business Purpose.

Brass Taxes has found that if you’re able to keep on top of tracking expenses consistently during the year, it’ll make things easier come tax season. You’ll also be better able to expense the little things that add up over time. Maximizing expenses is actually good, as this means you’ll only pay taxes on the profit that’s left over! Sample tax categories include: equipment, office supplies, software, work at home, etc. Check out Brass Taxes’s handy expense tracker, here.

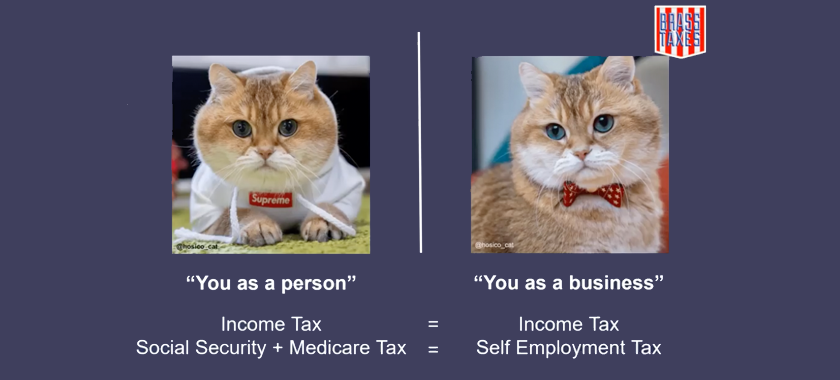

If you’re a business, you’ll pay both income tax and self-employment tax. “This is the main thing that catches people off guard, especially their first year freelancing or making a decent profit,” says Garofalo. “You need to know roughly how much money you’re going to owe at the end of the year, so you need to understand what percentage of your profit is going to go to taxes. Or you can also think of it as taking a portion of everything you’re paid before expenses come out,” he added.

You may need to pay taxes on grants you’ve received. “If it’s given in return for something, then it should be considered income. If it’s given with no-strings-attached, then it might be considered a gift,” says Stoddard. The nuanced details of your relationship with the payer matter here, and if you need further clarification check in with them to confirm.

Sales tax is a quarterly ongoing tax, whereas for most Brass Taxes clients they’re dealing with income tax. If you sign up to collect sales tax, you have to report back to the state government regardless of whether you have any sales or not. Garofalo notes that some folks sign up for sales tax to do one show, they stop reporting to the state, and then start getting scary letters. “The scary letters are just asking you to report that you have zero sales,” says Garofalo. If you do collect sales tax, send it to the state!

Know when to get help. If you have a W-2 and student loan interest, you probably don’t need tax help. However, if something in your life is going to change (you’re going to get married or buy a house, for example), you may want to get help to understand what’s coming. Generally if you’re making untaxed income and you’re not sure what might qualify as a business expense or you’re trying to make untaxed income, you may want to seek help.

If you determine that you do need tax help, consider someone who knows the industry that you work in who you feel comfortable speaking with. “The day-to-day of your industry will delineate what is an ordinary and necessary business expense,” says Garofalo. “Working out the specifics of what’s a good tax position requires understanding of your industry and life,” he added.

Please visit Brass Taxes’s website for answers to more frequently asked questions. For any new Brass Taxes clients, you can use 50NYFA for $50 off. NYFA thanks Brass Taxes staff Rus Garofalo, Founder; Eric Stoddard, Chief Operating Officer; Peter Cobb, Tax Advisor; and Kristen Fetchel, Client Experience Manager for all of their tax season expertise!

You can find more articles on arts career topics by visiting the Business of Art section of NYFA’s website. Sign up for NYFA News and receive artist resources and upcoming events straight to your inbox.

NYFA Learning provides artists, creators, students, and arts administrators with tools, strategies, and advice for building sustainable careers. We collaborate with organizations, academic institutions, and cultural partners to bring our programs to a broad range of national and international creative communities.